Tax Rate Directors Dividends . the following tables illustrate the 2021 corporate tax rates on income earned in a corporation, the corporate and personal. — the federal dividend tax credit rate for eligible dividends is approximately 15.02%. — an eligible dividend is any taxable dividend paid to a resident of canada by a canadian corporation that is. In summary, a dividend is. This preferential treatment means that if you. Summary of tax and credits. — for example, a board of directors might approve a dividend of $2.50 per share to class a common shareholders. — get the latest rates from kpmg’s corporate tax tables. This chapter discusses the tax implications of receiving a taxable dividend from a corporation resident in canada,.

from topforeignstocks.com

— for example, a board of directors might approve a dividend of $2.50 per share to class a common shareholders. — get the latest rates from kpmg’s corporate tax tables. the following tables illustrate the 2021 corporate tax rates on income earned in a corporation, the corporate and personal. — an eligible dividend is any taxable dividend paid to a resident of canada by a canadian corporation that is. — the federal dividend tax credit rate for eligible dividends is approximately 15.02%. Summary of tax and credits. This preferential treatment means that if you. This chapter discusses the tax implications of receiving a taxable dividend from a corporation resident in canada,. In summary, a dividend is.

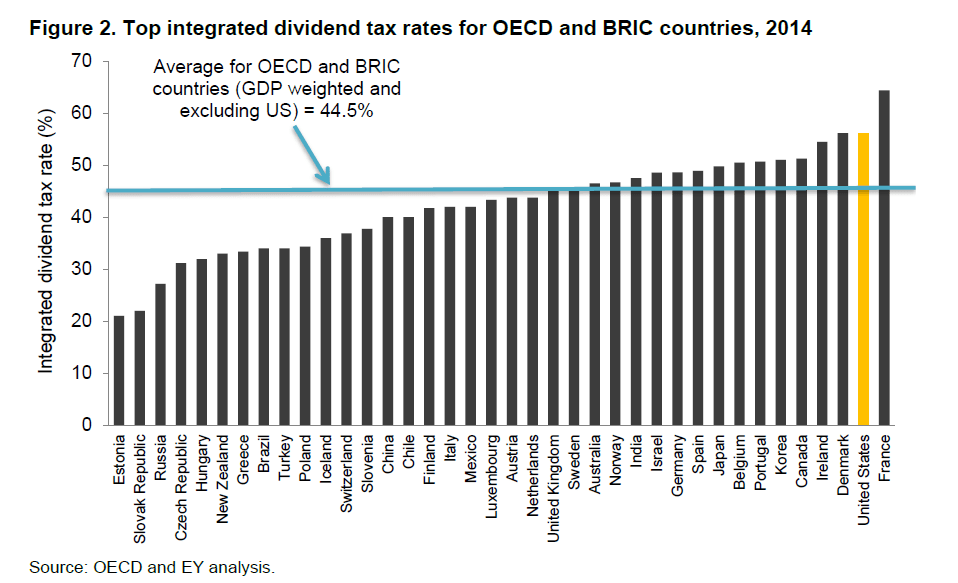

International Dividend Tax Rates Comparison Where Does The US Stand?

Tax Rate Directors Dividends the following tables illustrate the 2021 corporate tax rates on income earned in a corporation, the corporate and personal. Summary of tax and credits. In summary, a dividend is. the following tables illustrate the 2021 corporate tax rates on income earned in a corporation, the corporate and personal. This preferential treatment means that if you. — get the latest rates from kpmg’s corporate tax tables. — for example, a board of directors might approve a dividend of $2.50 per share to class a common shareholders. — the federal dividend tax credit rate for eligible dividends is approximately 15.02%. — an eligible dividend is any taxable dividend paid to a resident of canada by a canadian corporation that is. This chapter discusses the tax implications of receiving a taxable dividend from a corporation resident in canada,.

From www.scribd.com

Summary of Individual Final Tax Rates PDF Taxes Dividend Tax Rate Directors Dividends — an eligible dividend is any taxable dividend paid to a resident of canada by a canadian corporation that is. In summary, a dividend is. This preferential treatment means that if you. — for example, a board of directors might approve a dividend of $2.50 per share to class a common shareholders. — get the latest rates. Tax Rate Directors Dividends.

From topforeignstocks.com

Dividend Withholding Tax Rates by Country for 2023 Tax Rate Directors Dividends — the federal dividend tax credit rate for eligible dividends is approximately 15.02%. Summary of tax and credits. the following tables illustrate the 2021 corporate tax rates on income earned in a corporation, the corporate and personal. This preferential treatment means that if you. — an eligible dividend is any taxable dividend paid to a resident of. Tax Rate Directors Dividends.

From chacc.co.uk

The workings of Dividend tax in the UK for the Year 2021/2022 Tax Rate Directors Dividends — the federal dividend tax credit rate for eligible dividends is approximately 15.02%. This chapter discusses the tax implications of receiving a taxable dividend from a corporation resident in canada,. This preferential treatment means that if you. — get the latest rates from kpmg’s corporate tax tables. — for example, a board of directors might approve a. Tax Rate Directors Dividends.

From www.looniedoctor.ca

Explaining the Refundable Dividend Tax On Hand (RDTOH) & The New Passive Rules A Lesson Tax Rate Directors Dividends Summary of tax and credits. This chapter discusses the tax implications of receiving a taxable dividend from a corporation resident in canada,. — get the latest rates from kpmg’s corporate tax tables. — the federal dividend tax credit rate for eligible dividends is approximately 15.02%. the following tables illustrate the 2021 corporate tax rates on income earned. Tax Rate Directors Dividends.

From thefinance.sg

Definitive Guide to Dividend Withholding Tax in Stock & Passive Investing Tax Rate Directors Dividends — the federal dividend tax credit rate for eligible dividends is approximately 15.02%. This chapter discusses the tax implications of receiving a taxable dividend from a corporation resident in canada,. This preferential treatment means that if you. — get the latest rates from kpmg’s corporate tax tables. Summary of tax and credits. the following tables illustrate the. Tax Rate Directors Dividends.

From www.europeandgi.com

Foreign Dividend Tax Rates & How to Reclaim Withholding Tax in 2022 Tax Rate Directors Dividends — the federal dividend tax credit rate for eligible dividends is approximately 15.02%. — for example, a board of directors might approve a dividend of $2.50 per share to class a common shareholders. — get the latest rates from kpmg’s corporate tax tables. the following tables illustrate the 2021 corporate tax rates on income earned in. Tax Rate Directors Dividends.

From www.moneysense.ca

How the dividend tax credit works Tax Rate Directors Dividends — the federal dividend tax credit rate for eligible dividends is approximately 15.02%. — get the latest rates from kpmg’s corporate tax tables. the following tables illustrate the 2021 corporate tax rates on income earned in a corporation, the corporate and personal. This chapter discusses the tax implications of receiving a taxable dividend from a corporation resident. Tax Rate Directors Dividends.

From www.taxpolicycenter.org

T230020 Distribution of Individual Tax on LongTerm Capital Gains and Qualified Tax Rate Directors Dividends This preferential treatment means that if you. — for example, a board of directors might approve a dividend of $2.50 per share to class a common shareholders. In summary, a dividend is. — an eligible dividend is any taxable dividend paid to a resident of canada by a canadian corporation that is. — get the latest rates. Tax Rate Directors Dividends.

From topforeignstocks.com

Dividend Withholding Tax Rates By Country 2015 Tax Rate Directors Dividends — an eligible dividend is any taxable dividend paid to a resident of canada by a canadian corporation that is. This preferential treatment means that if you. In summary, a dividend is. — the federal dividend tax credit rate for eligible dividends is approximately 15.02%. Summary of tax and credits. This chapter discusses the tax implications of receiving. Tax Rate Directors Dividends.

From topforeignstocks.com

Dividend Withholding Tax Rates by Country for 2020 Tax Rate Directors Dividends This chapter discusses the tax implications of receiving a taxable dividend from a corporation resident in canada,. — the federal dividend tax credit rate for eligible dividends is approximately 15.02%. In summary, a dividend is. This preferential treatment means that if you. the following tables illustrate the 2021 corporate tax rates on income earned in a corporation, the. Tax Rate Directors Dividends.

From haipernews.com

How To Calculate Uk Dividend Tax Haiper Tax Rate Directors Dividends — an eligible dividend is any taxable dividend paid to a resident of canada by a canadian corporation that is. Summary of tax and credits. This preferential treatment means that if you. — for example, a board of directors might approve a dividend of $2.50 per share to class a common shareholders. This chapter discusses the tax implications. Tax Rate Directors Dividends.

From www.fkgb.co.uk

UK Tax Allowances and Tax Rates for 2022/23 Tax Year and Future Years FKGB Accounting Tax Rate Directors Dividends — for example, a board of directors might approve a dividend of $2.50 per share to class a common shareholders. — an eligible dividend is any taxable dividend paid to a resident of canada by a canadian corporation that is. This preferential treatment means that if you. This chapter discusses the tax implications of receiving a taxable dividend. Tax Rate Directors Dividends.

From cheap-accountants-in-london.co.uk

How Do Dividends Work In The UK? A Basic Guide Tax Rate Directors Dividends In summary, a dividend is. — the federal dividend tax credit rate for eligible dividends is approximately 15.02%. — get the latest rates from kpmg’s corporate tax tables. — an eligible dividend is any taxable dividend paid to a resident of canada by a canadian corporation that is. the following tables illustrate the 2021 corporate tax. Tax Rate Directors Dividends.

From www.dividenddiplomats.com

The Power of 50,000 in Dividend Explained Tax Rate Directors Dividends In summary, a dividend is. — for example, a board of directors might approve a dividend of $2.50 per share to class a common shareholders. the following tables illustrate the 2021 corporate tax rates on income earned in a corporation, the corporate and personal. — the federal dividend tax credit rate for eligible dividends is approximately 15.02%.. Tax Rate Directors Dividends.

From www.simplysafedividends.com

How Dividend Reinvestments are Taxed Intelligent by Simply Safe Dividends Tax Rate Directors Dividends — the federal dividend tax credit rate for eligible dividends is approximately 15.02%. This chapter discusses the tax implications of receiving a taxable dividend from a corporation resident in canada,. This preferential treatment means that if you. In summary, a dividend is. — an eligible dividend is any taxable dividend paid to a resident of canada by a. Tax Rate Directors Dividends.

From summitfc.net

Understanding Dividend Taxation Summit Financial Tax Rate Directors Dividends This preferential treatment means that if you. — the federal dividend tax credit rate for eligible dividends is approximately 15.02%. — get the latest rates from kpmg’s corporate tax tables. — an eligible dividend is any taxable dividend paid to a resident of canada by a canadian corporation that is. the following tables illustrate the 2021. Tax Rate Directors Dividends.

From taxfoundation.org

2020 Dividend Tax Rates in Europe Tax Foundation Tax Rate Directors Dividends — the federal dividend tax credit rate for eligible dividends is approximately 15.02%. This chapter discusses the tax implications of receiving a taxable dividend from a corporation resident in canada,. This preferential treatment means that if you. — for example, a board of directors might approve a dividend of $2.50 per share to class a common shareholders. In. Tax Rate Directors Dividends.

From taxfoundation.org

Dividend Tax Rates in Europe Dividend Tax Data Tax Foundation Tax Rate Directors Dividends In summary, a dividend is. This preferential treatment means that if you. This chapter discusses the tax implications of receiving a taxable dividend from a corporation resident in canada,. the following tables illustrate the 2021 corporate tax rates on income earned in a corporation, the corporate and personal. — the federal dividend tax credit rate for eligible dividends. Tax Rate Directors Dividends.